Request a Free Consultation

Serving Independent and Impartial Appraisal Services to:

Insurance Companies, Policyholders, Plaintiff and Defense Attorneys

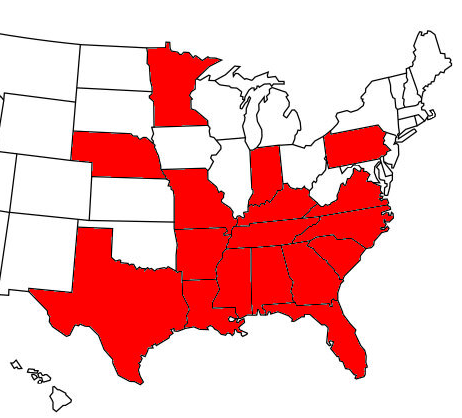

Offering Insurance Appraisal and Appraisal Umpire Services Nationwide with recent successful resolutions in:

AL, AR, DE, FL, GA, IA, IN,KY, LA, MI, MN, MO, MS, NC, NE, SC, TN, TX, VA, WY

Expert & Impartial

Our Services

Independent Appraiser

To resolve insurance disputes, Appraisal can be invoked by the property owner or insurance company. An independent appraiser can be hired to handle such disputes. Omega Insurance Appraisals has decades of experience and seasoned appraisers to handle any property loss appraisal in an independent and impartial manner.

Appraisal Umpire

When the appraisal process starts, both parties must select and agree on an umpire or a court of record having jurisdiction may select the umpire if the two appraisers are unable to agree. The designated umpire must be fair, impartial, and a disinterested party in the outcome of the appraisal. Omega Insurance Appraisals has umpires who have been thoroughly vetted by numerous courts and appointed by honorable courts in multiple states to serve as the neutral umpire for disputed property losses.

Expert Building Consultant

Sometimes the claim process is not yet ripe for Appraisal. Perhaps the insurance company has asked the policyholder for an estimate or measure of their damages. Perhaps the insurance company needs to retain a Building Consultant for assist in valuing or quantifying the amount of damage. Correctly establishing the proper scope of repairs to restore a damaged property back to pre-loss condition is an important step in every property damage claim. We have the expertise and decades of experience to accurately document and quantify the damages for any type of property loss. If the claim process has not yet reached a point of dispute and building consulting experts are necessary, please visit our sister company Omega Building Consultants for additional details.

"The Team of Experts at Omega are professional, detailed, and thorough. They helped us resolve our insurance dispute with excellence!"

We are a full service Insurance Appraisal and Appraisal Umpire Firm specializing in Alternative Dispute Resolutions

Our team of consultants are among the most respected professionals in the industry.

Once we receive your file, you can have confidence your property and interests will be represented with professionalism and expertise

In 2019, Toby J. Johnson saw a need within the insurance industry for an Appraisal company that could provide superior results without over-promising and under-delivering. Having acquired more than a decade’s worth of experience in the Appraisal arena and close to 20 years’ experience in the first-party property claims industry, Mr. Johnson is frequently called upon to serve as a neutral appraisal umpire across the country and has successfully resolved complex disputes on losses in excess of $40 million. Holding “IAUA” and “P.L.A.N.” appraisal and umpire certifications, Mr. Johnson has presided as an appraisal umpire in excess of 250 times for appraisals located in Alabama, Florida, Georgia, Indiana, Iowa, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Missouri, Nebraska, North Carolina, South Carolina, Tennessee, Texas, and Wyoming. Mr. Johnson has also been designated as a court appointed neutral umpire in numerous courts across Florida, Iowa, Kentucky, North Carolina, Tennessee, and Wyoming, and has also served as an arbitrator member for Arbitration Tribunals concerning property insurance dispute resolution matters. Mr. Johnson is also accredited as a Continuing Education (CE) Provider by the Florida Department of Financial Services specifically related to appraisal and umpire certification curriculum.

Striving for excellence through integrity, our team of appraisers and umpires are among the most respected professionals in the industry. When your file is with Omega, you can have confidence knowing your file will be handled with the utmost professionalism.

Wide Area of Expertise

Projects

Project 1

Location: Memphis, Tennessee

Role: Neutral Umpire

Customer: Both Parties

Dispute: 7-Figure

Loss Type: Wind Damage

Property: Church

Project 2

Location: Panama City Beach, Florida

Role: Neutral Umpire

Customer: Both Parties

Dispute: 6-Figure

Loss Type: Hurricane Damage

Property: Residential

Project 3

Location: Jackson, Tennessee

Role: Neutral Umpire

Customer: Both Parties

Dispute: 6-Figure

Loss Type: Hail Damage

Property: Commercial Retail

Project 4

Location: Humboldt, Tennessee

Role: Appraiser

Customer: Policyholder

Dispute: 7-Figure

Loss Type: Hail Damage

Property: Distribution / Manufacturing Facility

Project 5

Location: Charlotte, North Carolina

Role: Appraiser

Customer: Insurance Company

Dispute: 6-Figure

Loss Type: Water Damage

Property: Residential

Project 6

Location: Jackson, Tennessee

Role: Appraiser

Customer: Policyholder

Dispute: 6-Figure

Loss Type: Hail Damage

Property: Automobile Dealership

Project 7

Location: Dallas, Texas

Role: Appraiser

Customer: Insurance Company

Dispute: 6-Figure

Loss Type: Tornado Damage

Property: Residential

Project 8

Location: Memphis, Tennessee

Role: Appraiser

Customer: Defense Counsel for Insurance

Dispute: 6-Figure

Loss Type: Fire Damage

Property: Historical Residential

Project 9

Location: Louisville, Kentucky

Role: Appraiser

Customer: Plaintiff Counsel for Policyholder

Dispute: 6-Figure

Loss Type: Hail Damage

Property: Commercial Strip Center

Frequently Asked Questions

What is the Insurance Appraisal process?

Appraisal is a policy provision or condition that is found in most property insurance policies. It is considered an alternative dispute resolution when there is a disagreement over the value of a property insurance claim. Appraisal is an alternative to litigation and is typically a right afforded to both policyholders and insurance companies.

Appraisal is not designed to resolve disagreements over coverage, but to resolve disagreements that exist on covered losses. In the event of an appraisal, both the policyholder and the insurance carrier will appoint or hire their own appraisers. Tthese two appraisers will select an impartial 3rd party umpire to resolve any difference the two appraiser are unable to resolve. Typically, a decision or agreement by any two of the three appraisal panel members will set the amount of the loss.

Search for: What is the Insurance Appraisal process?

When is Appraisal Appropriate?

From time to time there is a disagreement over the value of a property loss between the insurance company and their policyholder. Sometimes the dispute is over coverage and in these instances, litigation is usually necessary. However, most of the time, the disagreement is not over coverage, but is over the value of the loss.

Fortunately, appraisal is a method to help resolve disputes without litigation or the need for legal counsel. Insurance companies might invoke appraisal if they believe the amount sought by the policyholder or their contractor is overstated. Policyholders might invoke appraisal if they believe the value of the claim offered by the insurance company is understated. Once there is a disagreement over the value of the loss, appraisal becomes appropriate.

Search for: When is Appraisal Appropriate?

What is an Insurance Appraiser?

Insurance appraisers are impartial professionals who estimate the value of a property loss. Most appraisers have a background in construction and/or the property insurance claims industry. Appraisers will review the facts of the loss, evaluate the property affected, and place an impartial and objective value on the loss. Impartial appraisers work for both policyholders and insurance carriers.

Search for: What is an insurance appraiser?

Is Appraisal better than litigation?

In most cases, appraisal is quicker and less adversarial as compared to legal actions. The cost for appraisal can be significantly less than litigation if your dispute is appropriate for appraisal. However, some disputes are not appropriate for appraisal and litigation is the only remedy. It is important to speak with legal counsel and appraisers in your state to determine which course of action is right for your situation.

Search for: Is Appraisal Better than Litigation?

What if the Appraisers do not agree?

Many times, the two appraisers are able to work through the differences and reach an agreement on the amount of the loss. If the two appraisers fail to agree, they will submit their differences to the umpire. The umpire is the informal and unofficial judge of the appraisal process. The umpire will resolve any differences that the two appraisers were unable to agree upon. Most insurance policies state a decision agreed to by two of these three (appraisal panel members) will set the amount of loss.

Search for: What if Both Appraisers do not agree?

What is the Appraisal Clause?

An appraisal clause is a clause or paragraph found in most but not all insurance policies. It is designed to be a way of reaching a settlement when there is a dispute over the amount of a loss between the policyholder and their insurance company and can be invoked by either party.

Search for: What is the appraisal clause?

Do I only pay for my Appraisal if I win?

Insurance appraisers typically do not work on a contingency basis unless the state they are working in allows such compensation. Typically, appraisers work by the hour or on a flat fee basis and will charge for their time regardless of the outcome. Most insurance policies stipulate that each party will pay its own appraiser and bear the other expenses of the appraisal and umpire equally.

Search for: Do I only pay for my Appraisal if I Win?

How much does an Insurance Appraisal cost?

Insurance appraisals can be a much cheaper option compared to litigation. Some appraisals can be resolved quickly for a few hundred dollars while other, more complex appraisals can cost tens of thousands of dollars. Generally, the smaller the dispute, the lower the cost of the appraisal. The higher the dispute, more time is likely needed to understand and resolve the dispute. Each loss is different and unique in their own way, so each project must be evaluated on a case-by-case basis for proper budgeting purposes.

Search for: How much does an insurance appraisal cost?

What Our

Clients Say.

Certified and Licensed

Contact Form

Fill this this form and one of our team members will contact you